Through its wholly-owned subsidiary Yarpa Investimenti SGR SpA, the Group has opened its investment strategy to significant third-party investors—both institutional and private—interested in sharing the same philosophy and risk appetite, accessing investment opportunities that are challenging for individual investors to reach.

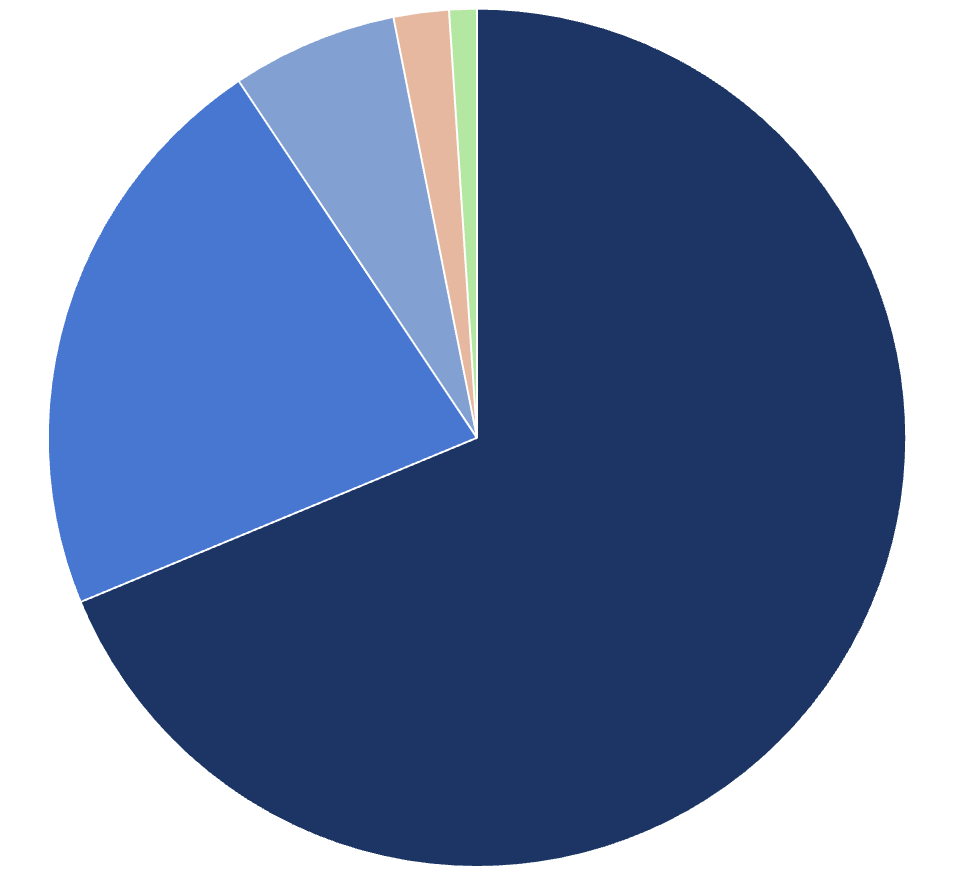

The offering is made through the establishment of Alternative Investment Funds (FIA) and Investment Mandates and targets institutional investors, family offices, foundations, pension funds, and High Net Worth Individuals (HNWI):

* Dated 06/30/2023, including funds and Investment management mandates.

Since 2012, Yarpa Investimenti SGR SpA has launched 8 closed-end private equity funds with aggregated capital exceeding €700 million, encompassing around 40 international funds active in small, mid/large, and growth capital strategies, and over 440 indirectly and directly participated investments.

Through a longstanding collaboration with a selected number of highly qualified international managers, the SGR provides a concrete response to the needs of institutional and private investors interested in diversifying their portfolios and participating in primary investment opportunities in the international private equity market.

Strategy Focus:

Through the SGR, the Group has also opened its investment strategies to third-party investors, offering an integrated set of value-added services throughout the investment lifecycle.

* Dated 06/30/2023, including funds and Investment management mandates.

* Data referring to 06/30/2023, including Investment Funds and Management Mandates.

Select a fund to learn more:

Vintage: 2012

Liquidation Date: 2019

Size: 30,6 M€

SFDR Classification: Art. 6

Number of Portfolio companies (look-through)*: 11

* including co-investments

Vintage: 2012

Liquidation Date: 2022

Size: 96,2 M€

SFDR Classification: Art. 6

Number of Portfolio companies (look-through)*: 44

* including co-investments

Vintage: 2014

Liquidation Date: 2023

Size: 31,2 M€

SFDR Classification: Art. 6

Number of Portfolio companies (look-through)*: 45

* including co-investments

Vintage: 2015

Size: 79 M€

SFDR Classification: Art. 6

Number of Portfolio companies (look-through)*: 80+

* including co-investments

Vintage: 2016

Size: 64,8 M€

SFDR Classification: Art. 6

Number of Portfolio companies (look-through)*: 80+

* including co-investments

Vintage: 2018

Size: 100,5 M€

SFDR Classification: Art. 6

Number of Portfolio companies (look-through)*: 140+

* including co-investments

Vintage: 2020

Size: 98,4 M€

SFDR Classification: Art. 6

Number of Portfolio companies (look-through)*: 80+

* including co-investments

Vintage: 2022

Size: n.a.

SFDR Classification: Art. 8

Number of Portfolio companies (look-through)*: n.a.

Vintage: 2024

Capitale sottoscritto: n.a.

Classificazione SFDR: Art. 8

Numero investimenti in portafoglio (look through) *: n.a.

Since July 2018, Yarpa Investimenti SGR SpA has been one of the first Italian authorized entities to manage individual portfolios focused on Private Equity investments. This choice is consistent with:

The first Investment Mandate for €60 million became fully operational in the last quarter of 2018.

In 2021, the same mandate was increased to €75 million, and in 2022, it was additionally increased to €95 million.

© 2023 Yarpa SpA

C.F. e P.I. 03354000105

Via Roma, 3

Genova (GE) 16121

Project Consult Srls

Designed by